|

|||

|

In this Update:

Co-Sponsor: Enhancing the Preservation of PA’s FarmlandIn the near future, I will be introducing legislation to expand Pennsylvania’s successful Agriculture Conservation Easement Purchase Program. An abundance of agricultural land is crucial to maintaining food security and protecting against supply chain instability for the commonwealth and our nation. According to the PA Department of Agriculture, the crucial agricultural industry provides a $135.7 billion annual economic impact and represents close to 18% of Pennsylvania’s gross state product. It also employs and supports nearly 580,000 people with combined wages of $27 billion. Pennsylvania’s agricultural land provides scenic images of rural life landscaped across fertile valleys of surrounding hills and mountains. These open spaces are a beautiful backdrop and draw thousands to our state to spend money in Pennsylvania’s growing agritourism business. In recent years, more and more prime farmland has been lost to development. According to Penn State’s College of Agricultural Sciences, the number of acres of farmland in Pennsylvania fell by 6% (7.3 million acres) between 2012 and 2017. The number of farms dropped by 10% (53,157) over that same period. Pennsylvania’s successful Agriculture Conservation Easement Purchase Program has been a nationwide model for farmland preservation. Under the easement program, 58 participating county programs receive state funds for the purchase of agricultural conservation easements. An agricultural conservation easement is a legal restriction that limits the use of the property to agricultural purposes and the landowner is financially compensated for the sale of the easement. Since 1988, the program has purchased permanent conservation easements on 5,979 Pennsylvania farms, covering 606,215 acres in 58 counties. Due to the popularity of the program, annual applications far outnumber the amount of available funding. My bill will increase dedicated annual funding by earmarking 25% of the realty transfer tax to go towards the easement program. This will equate to an average infusion of over $100 million additional annual funds for farmland preservation. Portions of the realty transfer fee are already dedicated to the Keystone Fund and the Pennsylvania Housing and Rehabilitation Enhancement (PHARE program) and I believe that the easement purchase program has proven itself worthy of also receiving dedicated funding. My legislation will also expand eligible farms by reducing the minimum subdivision size for preserved farmland from 50 acres to 25 acres. Additionally, the bill will also allow parcels less than 10 acres that are adjacent to preserved land or used to produce crops unique to the area to be eligible. Senate Acts to Extend Pandemic Waivers of Government Regulations

The state Senate this week voted to extend waivers of several regulatory statutes, rules and regulations to aid in Pennsylvania’s recovery from the COVID-19 pandemic. Senate Bill 1019 was signed into law as Act 14 of 2022. The waivers affecting health and human services, as well as consumers, workers and veterans, were due to expire Thursday. Act 14 extends the waivers until June 30, 2022. The waivers were initially implemented as part of the COVID-19 emergency declaration in 2020. In response to overreach by Gov. Tom Wolf, voters in 2021 stripped him of the authority he claimed to extend emergency declarations without approval of the General Assembly. Wednesday’s vote marks the third time the legislature has extended waivers. Some of the waivers extended through June 2022 allow for:

The new law also requires commonwealth agencies to issue a report to the public and the General Assembly identifying regulatory statutes, rules or regulations that were temporarily suspended that the agency believes should be considered for a permanent suspension. Independent Analysis Concludes RGGI Carbon Tax Could Increase Pennsylvania Electricity Costs 3.8 Times more than Wolf Administration Projections

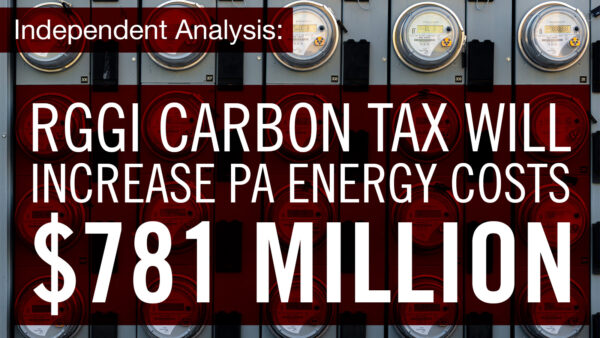

Impartial analysis from the Independent Fiscal Office (IFO) projects the Regional Greenhouse Gas Initiative (RGGI) could nearly quadruple new electricity costs for consumers. The nonpartisan IFO reviewed the Wolf administration’s outdated RGGI modeling and presented its findings to a joint hearing of the Senate Environmental Resources and Energy Committee and the Community, Economic and Recreational Development Committee on Tuesday. IFO Director Matthew Knittel said Pennsylvania could spend upwards of $781 million annually on emissions credits at the RGGI auctions – nearly four times the amount anticipated by the administration’s taxpayer-funded 2020 analysis used to justify Pennsylvania’s participation in RGGI. The IFO also warned members that “those costs would be pushed through to final customers.” The IFO analysis also concluded that emissions reductions between 2008 and 2020 for the 10 RGGI states were comparable to non-participating states. The administration’s effort to force Pennsylvania into RGGI is being challenged in court and could face additional legislative action. “Purple Star Schools” to Support Military Families Approved by Senate

The Senate approved legislation to have Pennsylvania join 28 other states in establishing a Purple Star School Program for students from military families. The measure was sent to the House of Representatives for consideration. The program is a state-sponsored recognition designed to acknowledge a public, private or charter school that has committed to supporting the unique educational and social-emotional needs of military-connected students. A Purple Star School designation means better ease and consistency in transferring schools so children experience fewer educational gaps and obtain meaningful support when frequently moving to new towns and schools as a military child. Senate Bill 1028 would provide “Purple Star” recognition to schools that: maintain a website with resources for military-connected students and their families, designate a staff point of contact for these students, provide training to school staff to best equip them to support these families, establish a partnership with a military installation, and take other steps. Senate Votes to Extend Disaster Emergency Declaration for Pittsburgh Bridge Collapse

The Senate approved a resolution to extend the disaster emergency declaration of Jan. 28 until Sept. 30 for the collapse of the Fern Hollow Bridge in Pittsburgh. The bridge’s collapse caused adverse impacts within the City of Pittsburgh, and traffic patterns are still disrupted. House Resolution 188 is necessary to help ensure the Pennsylvania Department of Transportation is eligible to receive emergency relief funding from the Federal Highway Administration. The bridge collapse injured 10 people. The cause is under investigation by the National Transportation Safety Board. Assistance Available for COVID-Related Funeral Expenses

Pennsylvanians who incurred funeral expenses for a COVID-19-related death can apply for the Federal Emergency Management Agency’s (FEMA) COVID-19 funeral assistance program to help ease the financial burden brought on by the pandemic. The program will provide reimbursement for expenses incurred for funeral services, including but not limited to transportation to identify the deceased individual, the transfer of remains, a burial plot or cremation niche, a marker or headstone, clergy or officiant services, the use of funeral home equipment or staff, and cremation or interment costs. Eligible applicants can apply for the funeral assistance program by calling FEMA’s COVID-19 Funeral Assistance Helpline at 1-844-684-6333 from 9 a.m. to 9 p.m., Monday through Friday to begin the application process. |

|||

|

|||

2024 © Senate of Pennsylvania | https://senatormastriano.com | Privacy Policy |