|

|||

|

In this Update:

Op-Ed: The Case for Property Tax EliminationSince I was elected Senator in 2019, I`ve heard from constituents on issues that span the spectrum of all areas of the state government. Their feelings on one particular issue have been very clear: The school property tax is the most hated tax in Pennsylvania (with the gas tax being a close second). The property tax is like paying rent to the government for land you own. It’s easy to see why this antiquated tax is so despised in all corners of the Commonwealth. More than 10,000 homes are seized annually in Pennsylvania and auctioned off for failure to pay the tax. It is particularly troubling that most of the home seizures are from our elderly. Many of our retirees on fixed income are faced with the stark choice of paying for food, medicine, or paying the tax. This is simply unacceptable. Property taxes also impede homeowners who long for the autonomy to expand their homestead. The way the tax works is that a government entity assesses a price for each piece of property owned. As a home becomes bigger or better, that assessment increases. Not only are homeowners shackled by this, but it also impacts local businesses that would otherwise benefit from selling materials and goods for home expansion. When presented via ballot referendum question in 2017, the people made their voice loud and clear. By a vote of 54% to 46%, voters statewide supported amending the Constitution to allow for the full elimination of property taxes for homeowners. Property taxes rates vary depending on the locality or county where a home is located. For example, Chester County has one of the highest average annual tax rates at $4,192 while the average in Philadelphia is $1,236. If we look at the median value of a home in Pennsylvania ($164,700) and the average rate (1.3%), the average Pennsylvania homeowner pays over $2,200 a year, according to Taxrates.org. A property tax of a few thousand dollars in addition to a monthly mortgage payment hurts individuals looking to maintain a home especially when they are on a fixed income or living paycheck to paycheck. Home ownership in PA has dropped from a high of 75% in 1999 to 70% in 2020. The common defense of those wanting to keep the property tax in place is that our state “can’t afford it” without drastically affecting the quality of education. I counter that we can make property tax elimination a reality with a little “outside the box” thinking. For starters, we need to reimagine how we fund education. By redirecting our state funds to follow students instead of systems, not only will we expand choice on where parents can send their children to school, but we will also save money. Currently, Pennsylvania spends over $19,000 per student each school year according to Department of Education statistics for 2019-2020. We are spending more on education than ever but not seeing better results when it comes to academic performance. Meanwhile, per pupil spending is about $15,000 for charter schools and the average cost of private school tuition is $11,800 a year. Establishing programs like Education Opportunity Accounts (EOAs) would provide families with direct access to educational resources. Individual school districts would no longer receive the average per pupil state education subsidy for the children who participate in the EOA program. Instead, the funds would be redirected to the child’s education opportunity account administered by the state treasurer and regularly audited by the state. With better accountability and increased competition for students amongst schools, Pennsylvania can actually save money on expenditures for education while improving its quality. Property tax elimination will lead to benefits in other sectors of our economy. The average tax savings of property tax elimination for all homesteads would have the same effect of annual stimulus checks for a household. In April 2020, households with two adults and an income under $150,000, received a total of $2,400 on average ($500 more for each dependent child). According to Forbes, 75% of those households spent their checks on household expenses to stimulate the economy. I think we would see a similar breakdown of spending percentage with property tax elimination and annual tax savings of over $2,000 for an average household. Increased consumer spending in our Commonwealth grows GDP. Businesses flourish and consumer sales increase with more demand. This growth ultimately leads to more annual money into the coffers of the General Assembly’s general fund available for education spending. We can also explore revenue alternatives that don’t hurt the wallets of everyday Pennsylvanians. Several of our private state universities are sitting on billions in untaxed endowment funds. University endowments are comprised of money or other financial assets that are donated to academic institutions. The largest in our state, Penn, has an endowment of over $20 billion after a 41% return from investments in 2021. Only a miniscule percentage of university endowment funds are expended per year and less than half of those small expenditures go towards tuition reduction and scholarships for students, according to the American Council on Education. Taxing endowments on wealthy private colleges in Pennsylvania would be significant annual revenue generator for the General Assembly’s general fund. Another untapped source for revenue is a fee on international remittances conducted by a money transfer licensee or agent. An international remittance is a sum of money that is electronically sent out of the Pennsylvania economy and into the economies of international destinations. Remittances are primarily utilized by illegal immigrants, foreign workers, and non-US citizens to send earnings back to a foreign country. Over $70 billion dollars is transferred out of the United States and into the economies of recipient countries on an annual basis. Considering Pennsylvania’s estimated foreign workforce, even a modest fee would generate significant annual revenue for the state. We also must look at getting our current spending under control. I believe that a thorough review of all 33 state government agencies will reveal significant waste and redundancy. Trimming the fat off these agencies will pay dividends for Pennsylvania in the long run, reduce the cost of our state government, and slash burdensome regulations. Better stewardship of the already exorbitant spending by Harrisburg is key to how can afford property tax elimination. As I’ve laid it out, full elimination is realistic and fiscally responsible. We just need the determination in Harrisburg to find ways to make it happen. In late 2019, I joined as a member of the Senate Majority Policy Committee working group on Property tax elimination. Sadly, that working group ended with the emergence of COVID-19 in 2020. I’m in favor of the group starting up again and would certainly sign up as a member. This session, I’ve gotten the ball rolling on a start to property tax elimination. My bill, SB 619, will exempt households for those who make $40,000 or less annually, are 65 or older, and have resided in Pennsylvania for at least 10 years. This is not a resolution to the property tax issue, but a short term action to keep some of our elderly from being kicked out of their homes. The modern model of property taxation has roots in the fourteenth and fiftieth centuries when feudal obligations were owed to British kings or landlords. British tax assessors used ownership or occupancy of property to estimate a taxpayer’s ability to pay. We must not forget that the Lamp of Liberty was lit right here in Pennsylvania in 1776. In the spirit of our founding fathers who rejected ancient European laws and customs, we can once again embrace our role as a beacon for freedom by eliminating all property taxes on homeowners in our Commonwealth. Mastriano reacts to Wolf’s final budget addressFebruary 8, 2022 HARRISBURG – Senator Mastriano provided the following statement after Governor Wolf’s final budget address to the General Assembly today: “Governor Wolf’s latest attempt to save the legacy of his failed Governorship has once again missed the mark. He bragged about being a fiscal steward and the state’s current surplus. He neglected to mention the surplus is mainly due to the influx of funds we received from the federal government. The only reason we are not in a deficit is because Republicans held the line on Wolf’s reckless spending requests over the past 7 years. “Wolf bragged about job creation under his tenure while we currently have the 11th worst unemployment rate in the United States. He also talked about cutting the prison population by 11,000. We see the disastrous results of that with the spike in violent crime in our metropolitan areas. “In a desperate attempt to save his legacy, Governor Wolf is intending to use billions in primarily federal funds to grow spending in Harrisburg. His proposed budget represents a 10.9% increase in spending. According to the Senate Appropriations Committee, that will produce a $1.3 billion deficit for FY 2023-24 and a $13 billion deficit by FY 2026-27. “When it comes to education, Wolf is proposing a 23% increase in basic education spending with little to no accountability or ties to performance-based metrics for public schools who will receive that money. He’s also proposing a significant increase in spending on universities; many of which already receive exorbitant funding but end up spending those funds on out-of-control administrative costs. While he props up public education spending, he seeks to cut funding for Charter schools by $373 million. “An alternate budget proposal would reign in unaccountable spending. Instead of using an influx of federal funds for Wolf’s final year wish list, we should be focusing on building up our reserve funds so that we can cut taxes. That way our citizens can keep more of their hard-earned money. We need to eliminate property taxes on homeowners and slash the gas tax. To do that, we need to control our spending. “We also need to rethink how we fund education in Pennsylvania. Instead of continuing to fund failing systems, lets redirect funding to follow the students. We should focus on expanding the successful EITC and OSTC scholarship programs and establish Education Opportunity Accounts to allow parents to have direct funding for tuition at a school of their choice. “I will only support a budget this Spring that gets the government off our backs and out of our wallets.” Co-Sponsor Memo: Timely Removal of Deceased Voters from the SURE systemIn the near future, I will be introducing legislation to ensure timely removal of deceased registered voters from the SURE system. In a 2020 lawsuit, the Public Interest Legal Foundation (PILF) provided the Department of State with the names of at least 21,000 deceased registrants who remained on the voter rolls less than a month before the 2020 election. According to PILF, 9,212 of these registrants had been deceased for at least five years, 1,990 had been deceased for at least ten years, and 197 had been deceased for at least twenty years. Following a briefing and a statement of interest by the U.S. Department of Justice in support of PILF’s position on key allegations in the case, the Department of State settled the lawsuit and agreed to compare its full voter registration database against the Cumulative Social Security Death Index. DOS also agreed to direct all county election commissions to immediately remove the names of deceased voters. Failure to quickly remove deceased registrants on a regular basis creates a vast opportunity for clerical errors, voter fraud, and abuse. My bill will amend Title 25 to state that the Department of Health must provide notice of a deceased individual to a county election commission within seven days of the individual’s death. Under current statute, Department of Health has up to 60 days to report the decreased individual. In Virginia, a similar bill recently passed the Senate with a significant bi-partisan vote. Gov. Wolf Sends General Assembly Budget Proposal with Huge Spending Increases

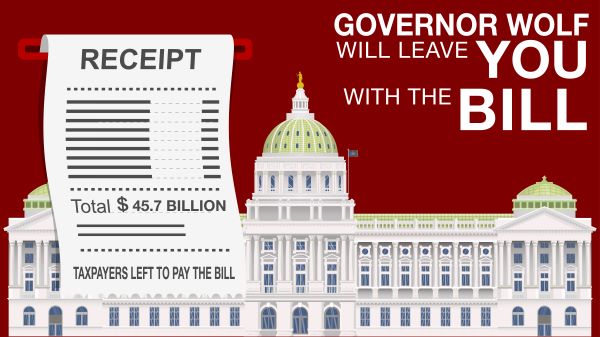

In an address to the General Assembly this week, Gov. Tom Wolf proposed a $45.7 billion 2022-23 state budget that would increase General Fund spending by $4.5 billion. The new spending includes $2 billion in federal American Rescue Plan Act funds. Including the expenditure of federal dollars returned to Pennsylvania during the pandemic, the governor’s budget represents a 10.9% increase in spending. According to Senate Appropriations Committee budget projections, the governor’s plan will produce a $1.3 billion deficit for the 2023-24 fiscal year and create an even bigger bill for Pennsylvania taxpayers to pay long after the governor leaves office: a $13 billion deficit by 2026-27. The Senate will hold a series of public hearings in the coming weeks to review the spending plan and produce a more responsible budget proposal that funds essential services while shielding taxpayers from the consequences of reckless overspending. Legislation Boosting Aid to First Responders Set for Enactment

Building on a promise to provide Pennsylvania’s frontline heroes with relief, the Senate approved legislation to provide $25 million in federal funding to support EMS providers. Since January, the General Assembly has advanced measures totaling $250 million for frontline workers, health care providers, emergency services and EMTs. The passage of Senate Bill 739 builds on the General Assembly’s recent efforts to distribute $225 million in federal relief funds for hospital and behavioral health providers to retain and recruit staff. The measure also would ensure that all fire companies – whether volunteer, paid or combination department – are eligible for the low-interest loans through the Fire and Emergency Medical Services (EMS) Loan Program. Voters approved expanding the program in a 2021 ballot question. Updated Agritourism Guide Available to Farmers

Agritourism activities – like corn mazes, hayrides, on-site dining/retail operations and educational programs – are a growing part of Pennsylvania’s agriculture economy. The Center for Rural Pennsylvania has an updated 128-page handbook to help farmers navigate agritourism issues. Last year, the General Assembly approved a new law to better protect farmers who offer these kinds of agritourism activities. Grants Available to Reduce Underage and Dangerous Drinking

The Pennsylvania Liquor Control Board (PLCB) is accepting applications for grants to fund programs that discourage and reduce underage and dangerous drinking and promote a message of responsible alcohol consumption by those of legal drinking age. Eligible grant applicants include school districts and institutions of higher education (including technical, trade and post-secondary establishments), community organizations, municipal police departments, municipal officials/representatives and nonprofit and for-profit organizations. The deadline to apply for grants is March 18. Applications and guidelines for submission are available on the PLCB website. Monday is National Donor Day

Monday isn’t just Valentine’s Day, it’s also National Donor Day. Many health groups use this day to sponsor blood and marrow drives and organ/tissue sign-ups. Organ donation saves lives and saves money, cutting health care costs by as much as two-thirds and saving Medicare millions of dollars every year. The General Assembly passed the Living Donor Protection Act last year, prohibiting insurers from discriminating against an organ or tissue donor. It also ensures family and medical leave is provided for an eligible employee for the preparation and recovery necessary for donation surgery. In addition, it requires development of informational materials relating to living donors and the benefits of live organ and tissue donation. |

|||

|

|||

Want to change how you receive these emails? 2026 © Senate of Pennsylvania | https://senatormastriano.com | Privacy Policy |